[Outsource & AAMC] SUBMIT YOUR EOI | AAMC RPL Diploma Program

- September 6, 2024

Dear Oxbridge Partners and Affiliates,

Outsource has just announced their renewed partnership with AAMC Training to bring you the FNS50322 Diploma of Finance and Mortgage Broking Management RPL Upgrade Workshop!

As part of our commitment to your professional development, Outsource and Oxbridge has negotiated an exclusive opportunity with AAMC Training Group (RTO 51428) to complete your Diploma via a Recognition of Prior Learning (RPL) pathway.

Why Choose This Pathway?

This streamlined process allows you to leverage your industry experience and knowledge as evidence for your qualification. Plus, you’ll receive complimentary virtual workshop support from expert trainers who will guide you through every step.

Workshop Details

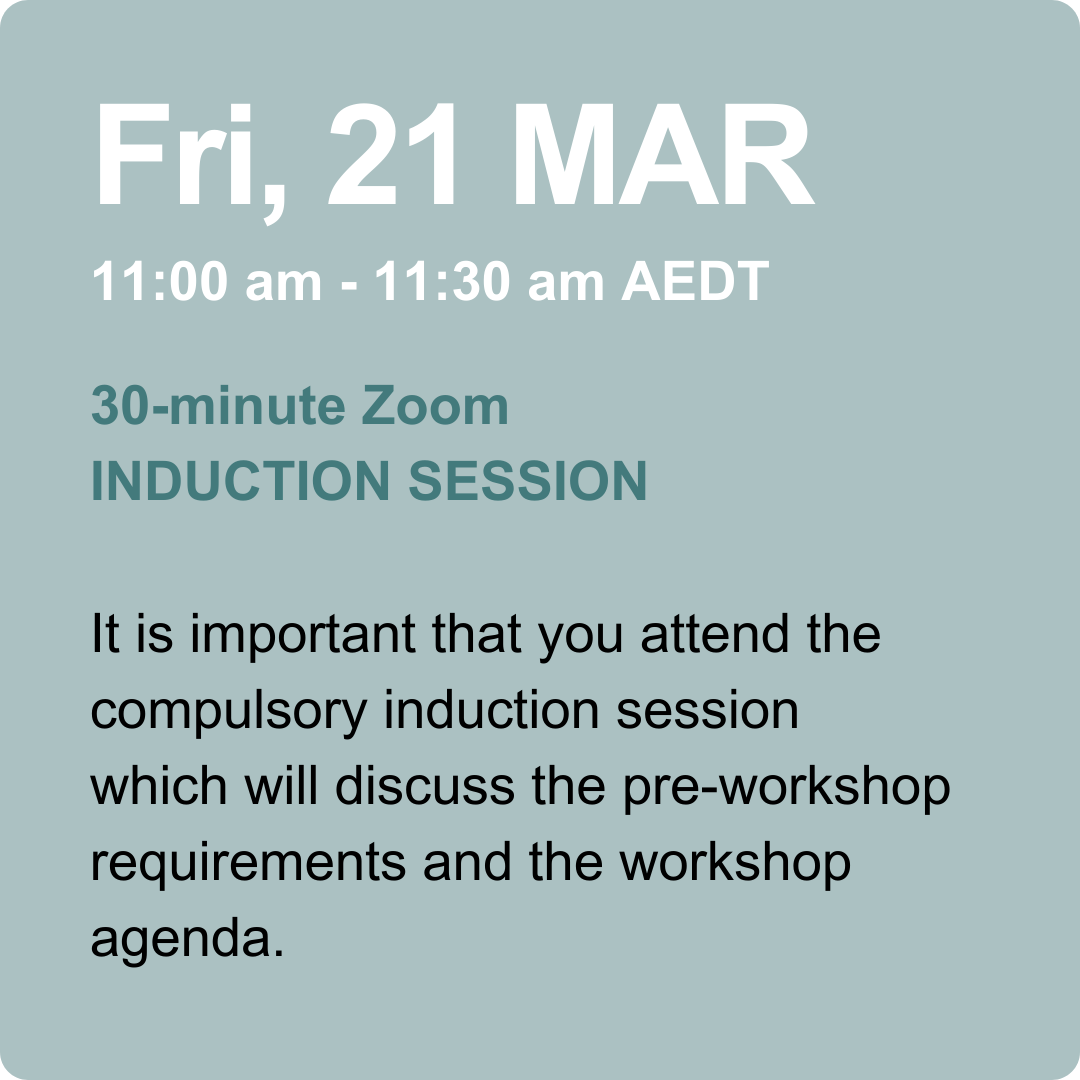

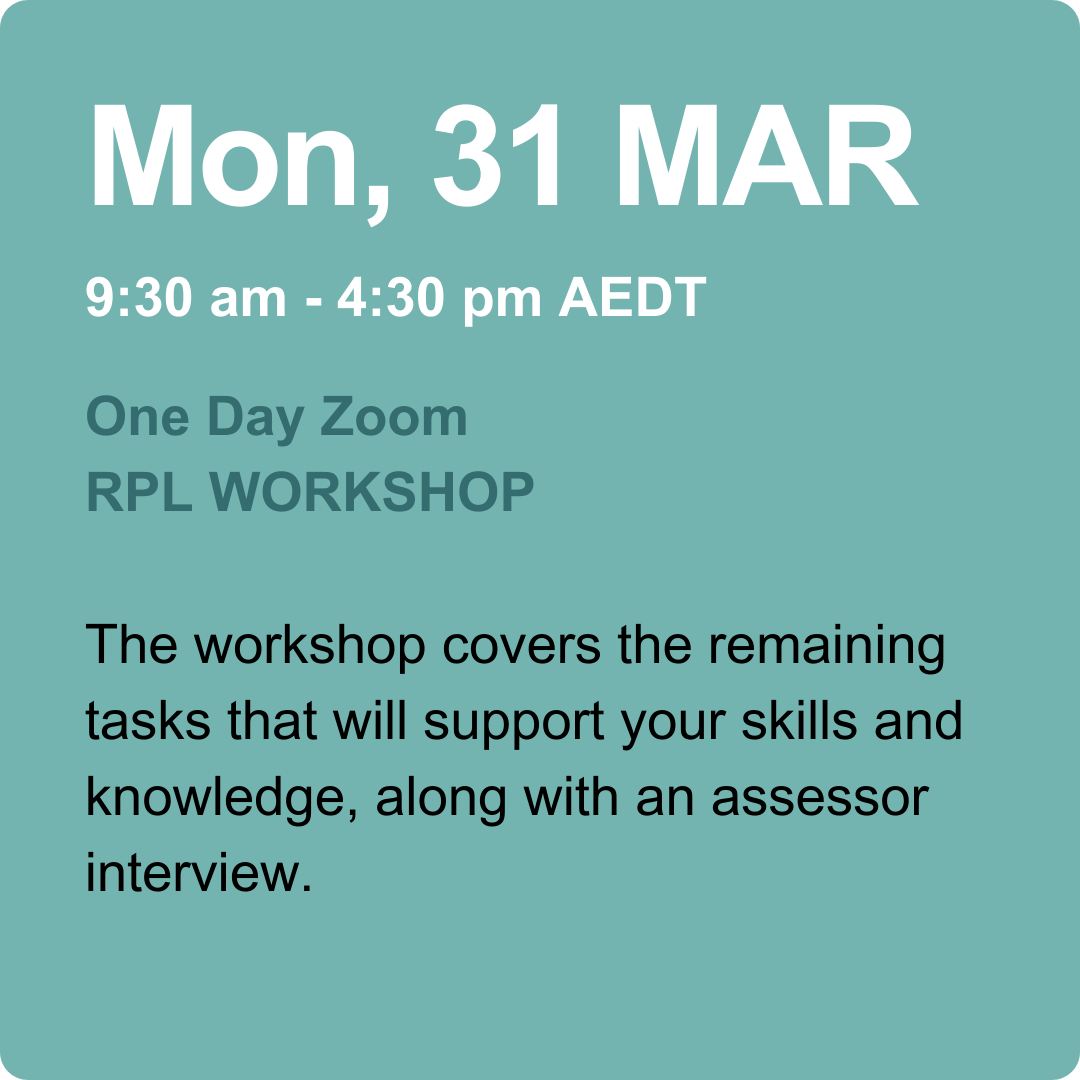

The workshop consists of two virtual sessions, with additional tasks to be completed post-workshop if necessary.

Course Options & Pricing

| Course Option | Standard Price | Special Price (with Outsource) | Savings |

|---|---|---|---|

| FNS50322 Diploma (Upgrade from Cert IV FNS10-15 RPL) | $897 | $697 | Save $200! |

| FNS50322 Diploma (Upgrade from Cert IV FNS20-21 RPL) | $797 | $597 | Save $200! |

| FNS50322 Full Diploma (for Cert IV prior to 2010 – FNS40804) | $997 | $897 | Save $100! |

How to Apply

- Check your eligibility – Click here to see if you qualify.

- Submit your application – Complete the RPL Pre-Qualification Form and email it to Ella Moradi (emoradi@aamctraining.edu.au). See https://files.constantcontact.com/d57de6f5201/86cb9dcb-ca24-4532-8e93-d49ea78f3463.pdf

- Have questions? – Call (03) 9391 3643 for assistance.

📢 Enrolments close Friday, 14 March 2025 – Spots are limited, so secure your place now!

This is a fantastic opportunity to upgrade your broker credentials, expand your skill set, and gain further accreditations with Lender Partners—all through a faster and more efficient process.

Let’s kickstart 2025 with a professional edge! 🚀

Oxbridge delivers 60-80 leads per hour – that’s 40,000-50,000+ leads per month, including first-home buyers (FHO), investors, owner-occupiers, and refinance leads! Plus, you have the freedom to generate your own leads. As an aggregator-agnostic platform, we provide flexibility and access to multiple lending solutions, including private finance and private capital raising. Oxbridge provides training on objection handling, lead conversion, and lead generation to help you maximize your success!

ABOUT THE PRIVATE FINANCE MORTGAGE BROKERING BUSINESS

Private Finance Mortgage Brokering is a phenomenal industry that offers truly passive income and the ability to build your book. The average income of mortgage brokers at Oxbridge is an impressive $195,000 (https://www.theadviser.com.au/supplements/the-adviser-digital-magazine/2024/elite-broker-ranking-2024-residential/11-cover-elite-broker-rankings) whilst top brokers can earn over $2m a year often in passive income (https://www.afr.com/companies/financial-services/inside-the-unstoppable-rise-of-australia-s-mortgage-brokers-20240524-p5jg8b). The best thing about finance brokering is the TRUE PASSIVE INCOME. Very few professionals are qualified in both real estate and mortgage brokering. The key to a successful mortgage broking business are the leads. With over 5,500+ online listings and another 1,000 off market listings the Oxbridge Real Estate business side provides an excellent source of lead generation

Although the details around when and how brokers receive commission varies from lender to lender, generally speaking: Upfront commission: 0.65% (+GST) to 0.85% (+GST)

The upfront commission is the largest component of the commission. The broker receives this once your loan settles. Trail commission is what the broker receives every month for the life of the loan. Usually, this trail is set at 0.15%-0.40% per annum based on the remaining loan amount each year. To be clear, mortgage brokers don’t work for the banks, although there are some mortgage brokerages that are partly-owned by banks and larger lenders. Oxbridge is always 100% independent (e.g. Aussie is owned by Lendi which is owned by numerous shareholders including CBA, 1835i (ANZ’s external venture capital partner) and Macquarie Bank, RAMS is owned by Westpac, REA owns Mortgage Choice etc)

Working on a typical loan size of $850,000 and writing 20 loans in the first year. The commission received by the broker would be

$750,000 (20 x 0.70% + 20* 0.45%) = $119,000 (upfront) + $76,500 (Trail) = $195,500

Top brokers in Australia receive well in excess each year of $3M upfront commission and at least 3x that in terms of trail commissions for the life of the loan. Several Oxbridge brokers are doing exceptionally well earning 7 figure incomes. Some Oxbridge members are dual qualified in mortgage brokering and real estate which is a huge competitive advantage in the market place. Trail commission is really true passive income

The Oxbridge Finance Team